An Introduction to Credit Risk in Banking: BASEL, IFRS9, Pricing, Statistics, Machine Learning — PART 2 | by Willem Pretorius | Medium

An Introduction to Credit Risk in Banking: BASEL, IFRS9, Pricing, Statistics, Machine Learning — PART 2 | by Willem Pretorius | Medium

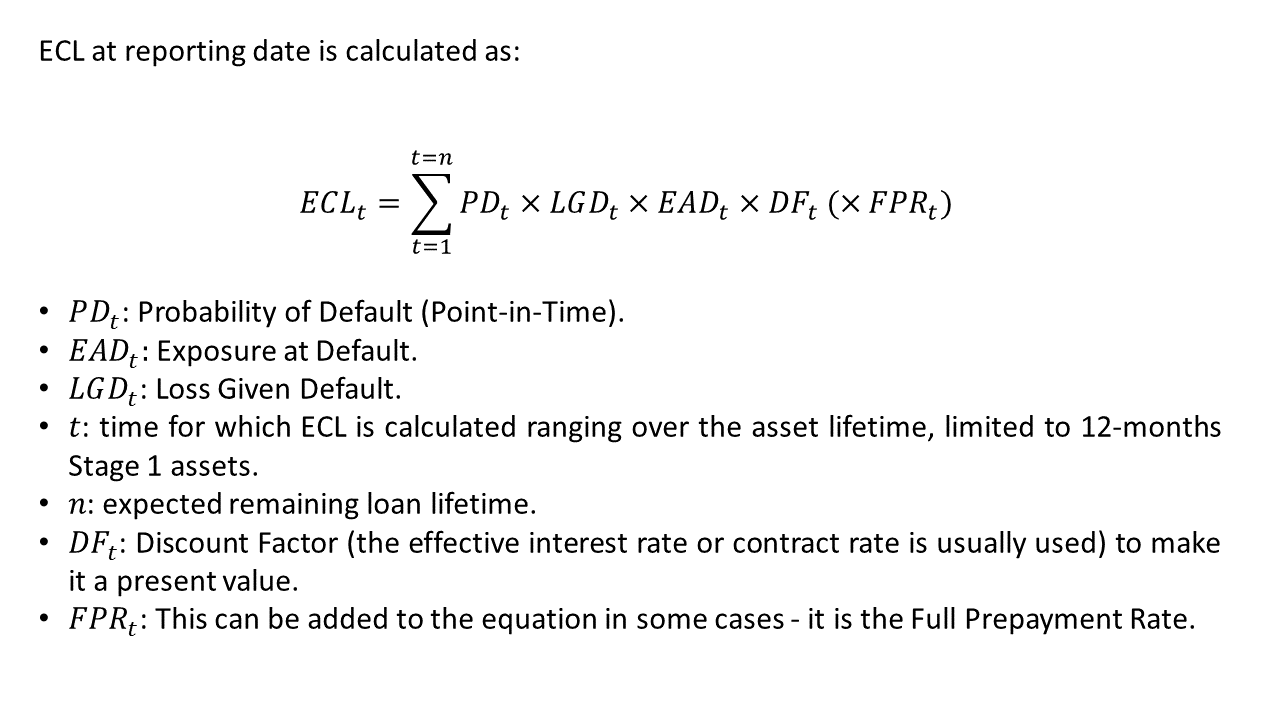

THE IMPLICATIONS OF IFRS 9 – FINANCIAL INSTRUMENT STANDARD EXPECTED CREDIT LOSS MODEL IMPLEMENTATION ON FINANCIAL STATEMENTS O

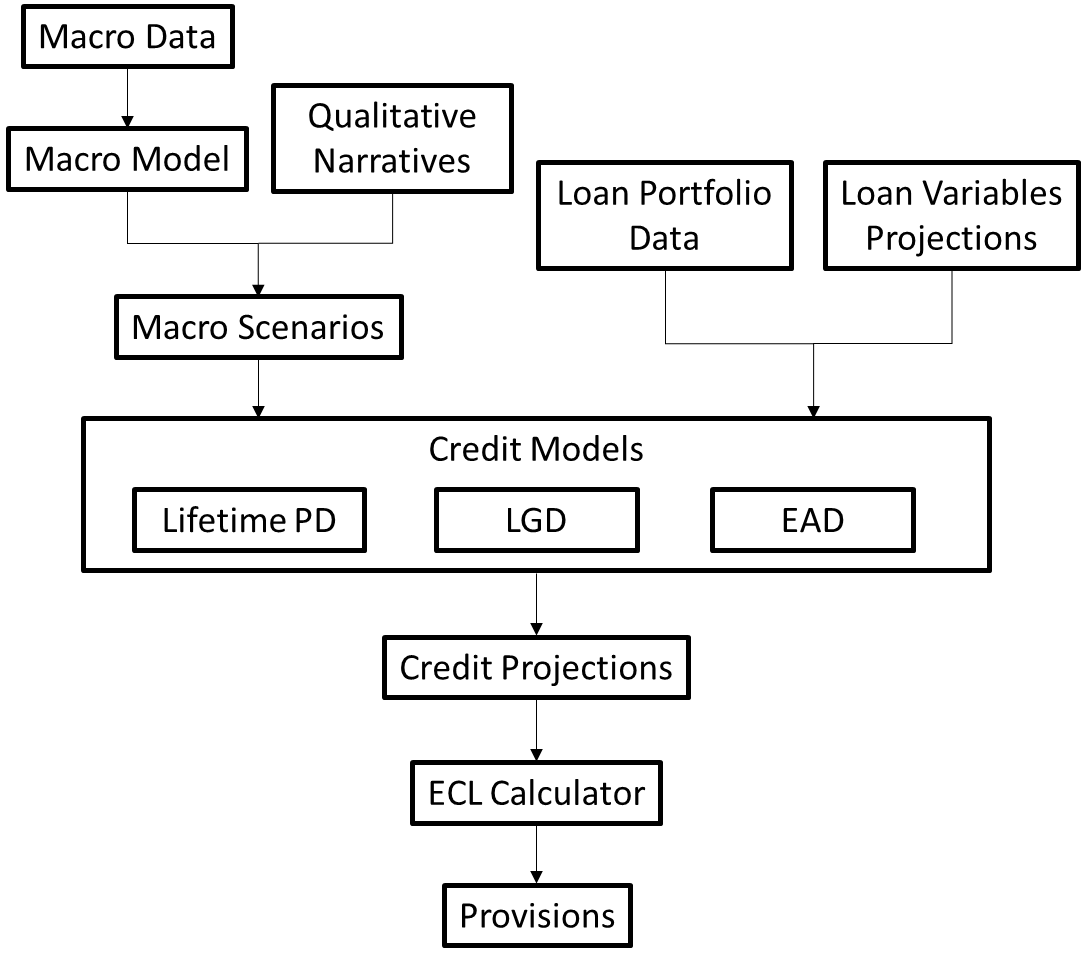

Incorporate Macroeconomic Scenario Projections in Loan Portfolio ECL Calculations - MATLAB & Simulink

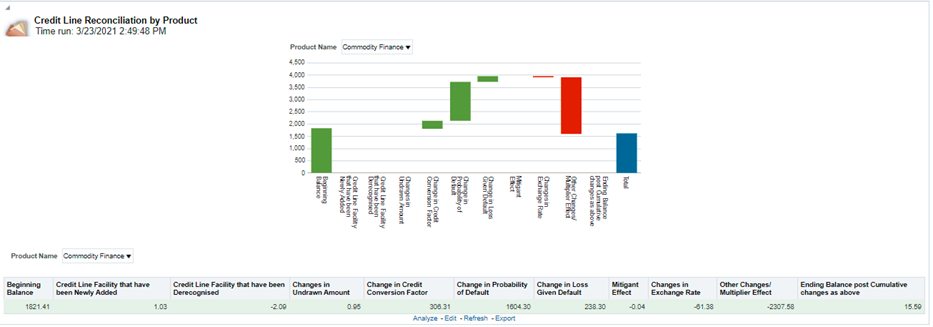

How to estimate exposure at default (EAD) by credit products | Gabriel Ryan, FRM posted on the topic | LinkedIn

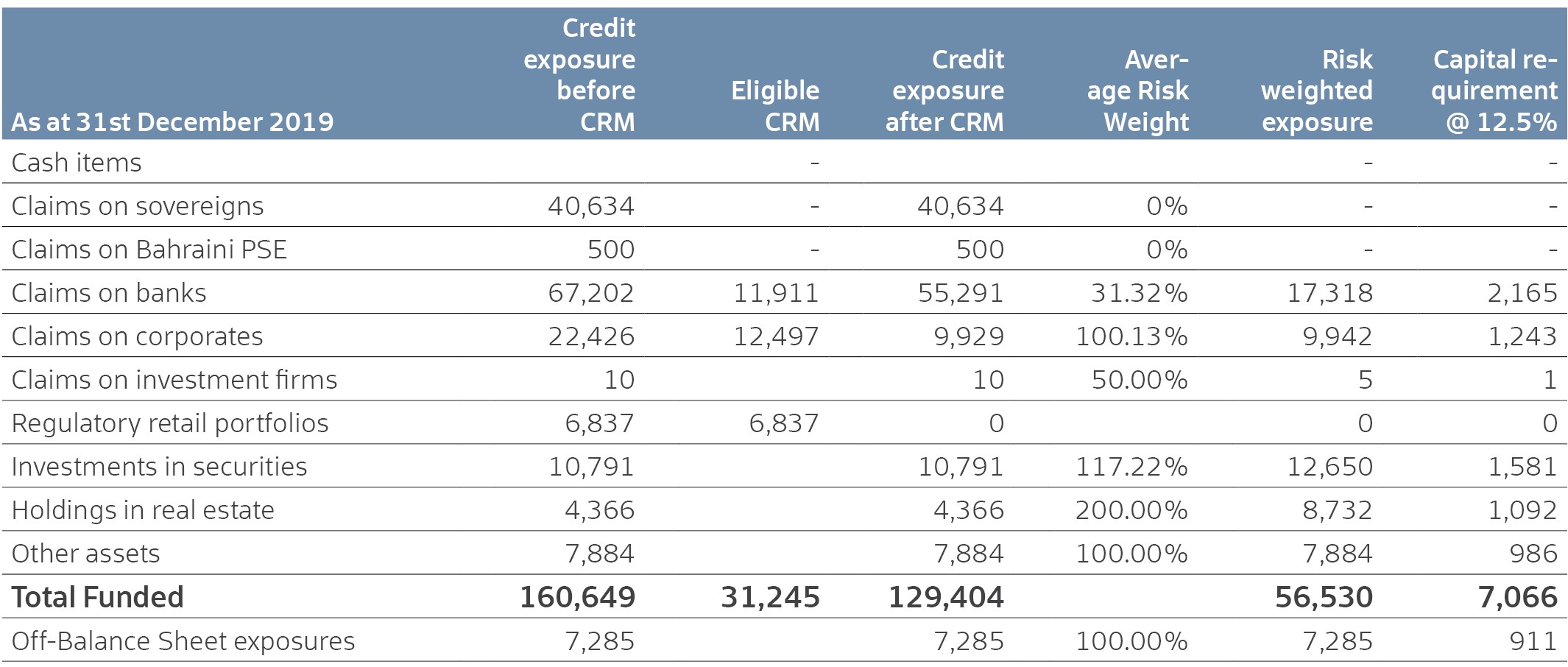

![PDF] Exposure at default models with and without the credit conversion factor | Semantic Scholar PDF] Exposure at default models with and without the credit conversion factor | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/3ba760670e32d0bb47ce2d447e12ddb2d783651d/12-Table1-1.png)